College affordability is likely top of mind for parents or students pursuing a higher education. When evaluating the total cost of college, it’s important to consider and plan for all expenses, including tuition, housing, meals and more. Peoples Bank in North Carolina can help you plan to develop your college budget.

The cost of a college education has risen significantly over the last 20 years and continues to outpace inflation. Beyond tuition, other school-related costs have also increased, such as books, technology and living expenses. To plan appropriately, it’s smart to understand how these costs break down and what you can do to defray them.

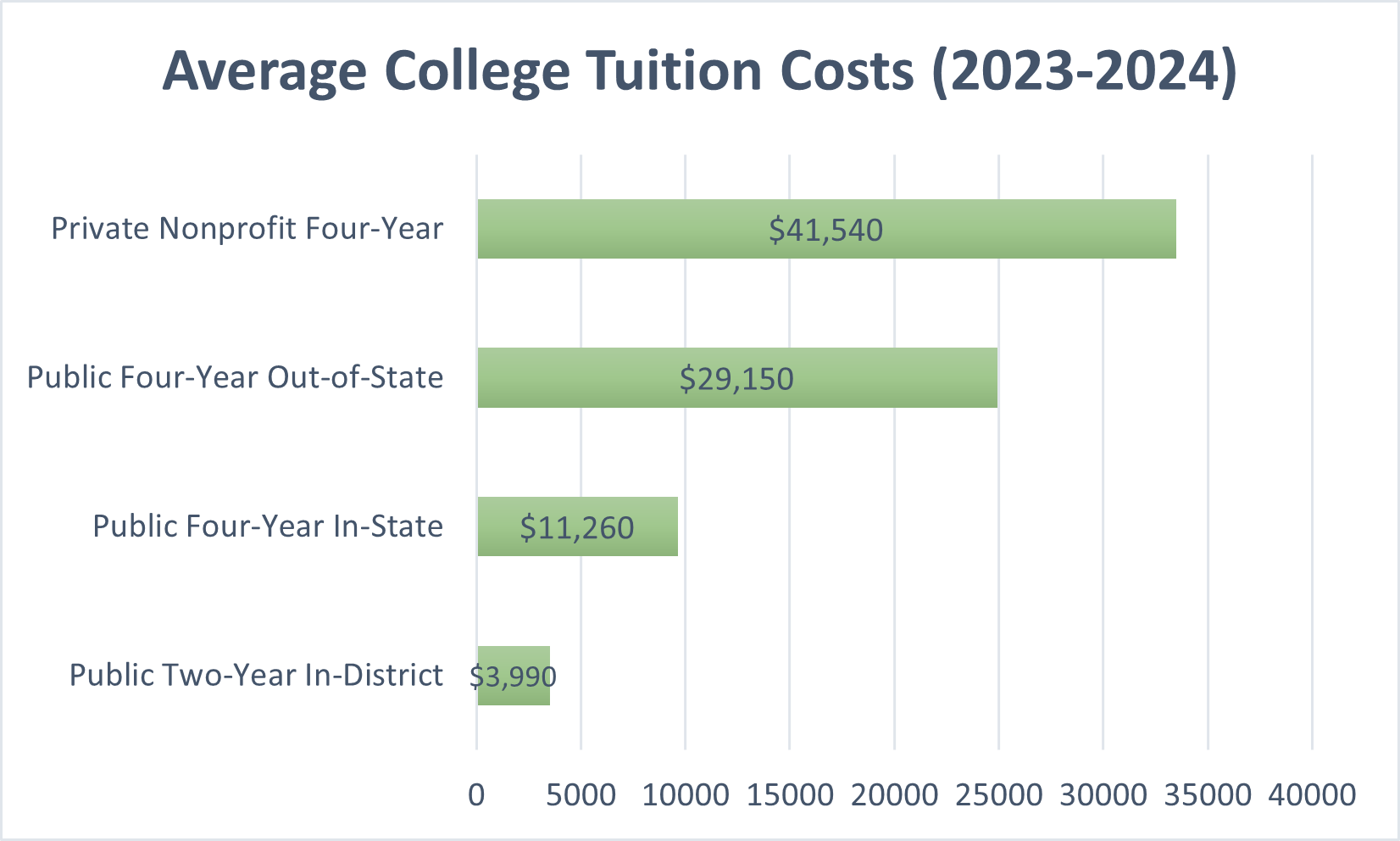

Tuition costs differ among public and private institutions, two-year and four-year schools and across regions and states. The cost of college tuition and fees will vary based on the type of school you attend and the length of time you spend studying. A recent survey by the College Board reported the national averages for college tuition for the 2023-2024 academic year for public and private schools.

Tuition at public colleges is often less expensive for in-state residents but could be double the cost for out-of-state students. College tuition costs also vary based on the school’s location. For the 2023-2024 academic year, the average annual cost of a four-year private college was $41,540, including tuition and fees.

For more detailed information on how much a specific college or university may cost, explore the College Affordability and Transparency Center from the U.S. Department of Education.

Room and board constitute another major expense in college. The cost of on-campus living depends on the campus housing and food plans you select. According to Education Data Initiative, room and board on campus costs an average of $11,520 at four-year public schools and $11,720 at private schools, but these figures will vary by region.

Depending on location, off-campus living can be a cost-effective alternative. It’s important to note, however, that many college towns are pricey, so be sure research rentals in the area. Food and travel are also factors—consider transportation to and from campus and meal planning for full days of classes. Some schools offer a pay-as-you-go option at dining halls, or reduced meal plans for off-campus students.

Every college student needs textbooks and school supplies, which adds to the total cost of education. College Data estimated books and supplies to cost $1,240 in the 2022-2023 academic year. Most schools will provide an estimate of the average costs for the required learning materials based on the program the student is entering.

Don’t forget to consider personal expenses when creating a college budget. These expenses include laundry, dining out, transportation, cell phone, entertainment, clothing and more. To keep these costs in check, it’s important for college students to learn valuable money management skills.

Financial aid, scholarships and grants can be great ways to offset the cost of tuition. Undergraduate college students received an average of $15,480 and graduate students received an average of $28,300 in grants, federal loans and other aid during the 2022-2023 school year, according to the College Board. Grants are awarded based on financial need, while scholarships are awarded based on academic or athletic achievement. Unlike student loans, these options are often referred to as “gift aid” and do not need to be repaid.

You can also defray the cost of books and supplies by buying, renting or selling your textbooks, or using digital versions.

Even if college seems far off, it’s smart to begin saving to pay for college as early as possible. Start putting aside money in a Coverdell Education Savings Account or talk to an accountant about the tax advantages of a 529 college savings plan.

Peoples Bank in NC can help make saving for college less overwhelming. Contact us or visit a local branch to get started on your savings plan.

Peoples Bank will NEVER call or text you and ask for personal information, including account numbers, debit card numbers or online banking passwords. While we do contact customers about potentially fraudulent activity, no one should ever call or text you to make an account change or provide personal information.

If you receive a call from someone claiming to be a Peoples Bank representative and you are suspicious, hang up and call the number listed on your account statement or our official website: 877-802-1212.